AI in Fintech: Making Smarter Investment Decisions

AI is helping fintech companies make faster decisions and manage risk with less manual work. Tasks that once took hours, like reviewing loan applications or spotting fraud, can now happen in seconds.

But along with these gains come real challenges. Businesses have to think about things like bias in AI models, how accurate the decisions are, and what to do when something goes wrong.

The value of AI is easy to see. It helps lenders approve more people fairly and assist payment platforms in blocking fraud before the money is lost.

Even with concerns like data quality and model fairness, the right tools make it possible to build AI systems that are useful and easy to manage.

In this article, we’ll explore how AI is used in fintech, and you’ll see how companies apply it to real business problems. Whether you're starting from scratch or improving an existing system, this guide will help you understand how to bring AI into your fintech business with purpose.

What Is Fintech and How Does AI Fit In?#

Fintech or financial technology refers to any digital tool that helps people or businesses manage, move, or understand money.

This can include mobile banking apps, online loan services, digital wallets, accounting software, and even platforms that help people invest or buy now and pay later.

What makes fintech different from traditional financial institutions is the use of modern software to solve problems faster and more affordably.

Artificial intelligence (AI) is a technology that studies data, learns patterns, and makes decisions. Once it has enough data, it can handle tasks automatically.

In fintech, AI systems help companies reduce mistakes and serve more users. It can process loan applications, detect fraud, help customers through chat, or suggest personalized financial advice without waiting for a person to step in.

The combination of AI and fintech lets you do more with less. You spend less time on manual processes and more time focusing on business growth. If you’re building products in finance or need smarter support tools, this pairing offers measurable value.

How Fintech Companies Benefit from AI#

AI is changing how fintech firms operate. These are the main benefits your business can expect when applying AI-powered tools to your fintech platform.

Faster Decisions#

AI algorithms review customer data and make decisions instantly. You can approve loans, verify payments, or respond to customer interactions. It saves your team time and reduces wait time for users.

For example, a loan decision that used to take hours can now happen in under a minute. AI checks financial transactions, spending habits, and patterns to make a decision right away.

Stronger Fraud Detection#

AI helps you spot fraud before it becomes a problem. It monitors behavior, tracks past activity, and reacts to new patterns. Unlike rule-based systems, AI adapts as it learns.

This helps you catch real threats while cutting down on false alerts. Users feel safer, and your risk team spends less time on manual reviews. It also plays a key role in fraud prevention, detecting potential risks in real-time by analyzing sensitive financial data.

Lower Operational Costs#

AI-powered solutions handle repeat tasks so your team doesn’t have to. This includes answering common support questions, checking documents, sending reminders, or routing tickets.

With tools like Denser, you can launch a chatbot that manages these tasks from day one. Your team focuses on complex work while AI takes care of the rest. This means lower costs without cutting service quality.

Better Customer Support#

AI gives customers fast answers at any time of day. A well-trained chatbot can guide them through account setup, help with payments, or explain your services.

Using Denser, you can design support flows that respond to real questions, offer follow-ups, and even collect feedback without human agents getting involved.

This improves the user experience and keeps customers from getting frustrated or leaving.

More Accurate Risk Assessment#

AI-powered tools review more data than a person can. It can scan spending behavior, past loan performance, and real-time signals to give you a better picture of credit risk.

This allows you to offer more flexible options, serve more customers, and reduce bad debt. It also helps you avoid turning away users who don’t fit a traditional risk model but are still trustworthy.

Improved Compliance Tracking#

In finance, regulatory compliance rules matter. AI helps you stay within legal limits by monitoring financial transactions and flagging unusual behavior.

It also makes it easier to create logs and reports if you need to respond to audits or regulators. This gives your compliance team the tools they need to do their job well without drowning in paperwork.

How Is AI Used in Fintech?#

AI handles large volumes of customer data, reduces response times, and helps financial companies operate better. Here’s how it’s being used across different parts of the fintech sector.

Fraud Detection and Transaction Monitoring#

AI algorithms are trained to identify suspicious patterns in transaction data. They analyze vast amounts of customer data, locations, spending history, and device activity to flag fraud in real-time. It prevents financial losses and helps maintain user trust.

Unlike rule-based systems, AI adapts to new fraud methods. As it learns from real events, it becomes more accurate and lowers the number of false alerts, which is a major advantage in the finance industry.

Loan Approvals and Credit Scoring#

Traditional credit models rely on limited data, like credit scores or income reports.

AI-powered solutions expand this by analyzing customer data such as cash flow, job stability, and spending behavior. It helps fintech firms serve more customers, especially those with little or no credit history, and even offers tailored financial advice.

Chatbots and Virtual Assistants#

AI chatbots answer questions, guide users, and automate tasks. They’re used for support, onboarding, and user education.

With platforms like Denser, you can set up a chatbot to work across your website or app. It can check order status, help with forms, or guide new users without your support team getting involved.

Investment Advice and Portfolio Management#

Robo-advisors use AI to help customers make investment decisions. They ask about goals, risk tolerance, and income, then build a custom portfolio.

The system checks the market daily and adjusts the mix of investments automatically. This keeps the portfolio aligned with user goals without the need for a human advisor.

It also opens the door to investing for users who don’t want to pay high advisory fees.

Algorithmic and High-Speed Trading#

AI is used in stock trading to make split-second decisions. It looks at news, market signals, and historical patterns to decide when to buy or sell.

These systems respond faster than any human could. They're used by hedge funds and platforms that trade in high volumes, but some retail tools now include generative AI models as well.

Payment Processing and Smart Routing#

AI helps payment platforms choose the best route for each transaction. This can reduce fees, improve success rates, and speed up delivery.

It can also detect payment issues like expired cards or mismatched data before they cause failures. If your fintech product processes payments, using AI in the background can save time and money.

KYC and Onboarding#

Know Your Customer (KYC) is a required step for most fintech platforms. AI automates ID checks, document scans, and background searches. It speeds up account creation and lowers the chance of fraud.

With tools like facial recognition and document matching, you can approve new users in minutes instead of hours. This is key for a smoother onboarding experience and compliance within the finance industry.

User Behavior and Predictive Analytics#

AI reviews how users interact with your platform. It spots patterns, predicts what users might do next, and suggests ways to keep them active.

For example, if a user shows signs of leaving, the AI can prompt a message or offer before they drop off.

Using a tool like Denser, you can turn these insights into chatbot actions. If the AI notices a drop in engagement, your chatbot can reach out and offer help before the user leaves.

5 Examples of AI in Fintech#

If you’re exploring how to bring AI into your own fintech business, it helps to see what others are already doing. Here are a few examples of what companies gain with this while staying aligned with current market trends.

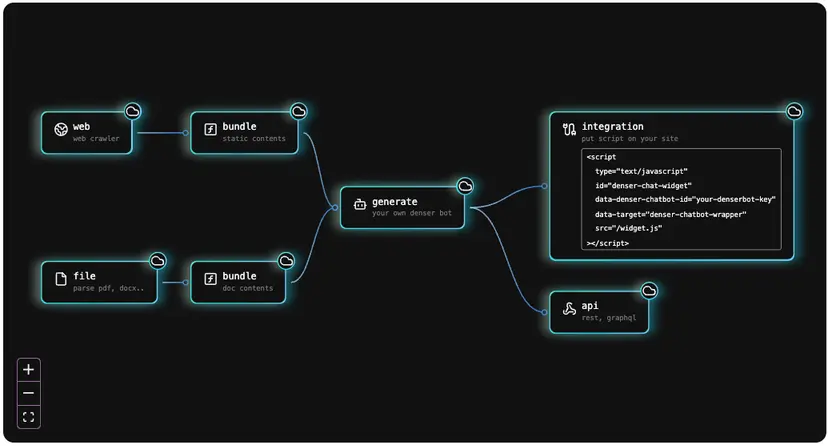

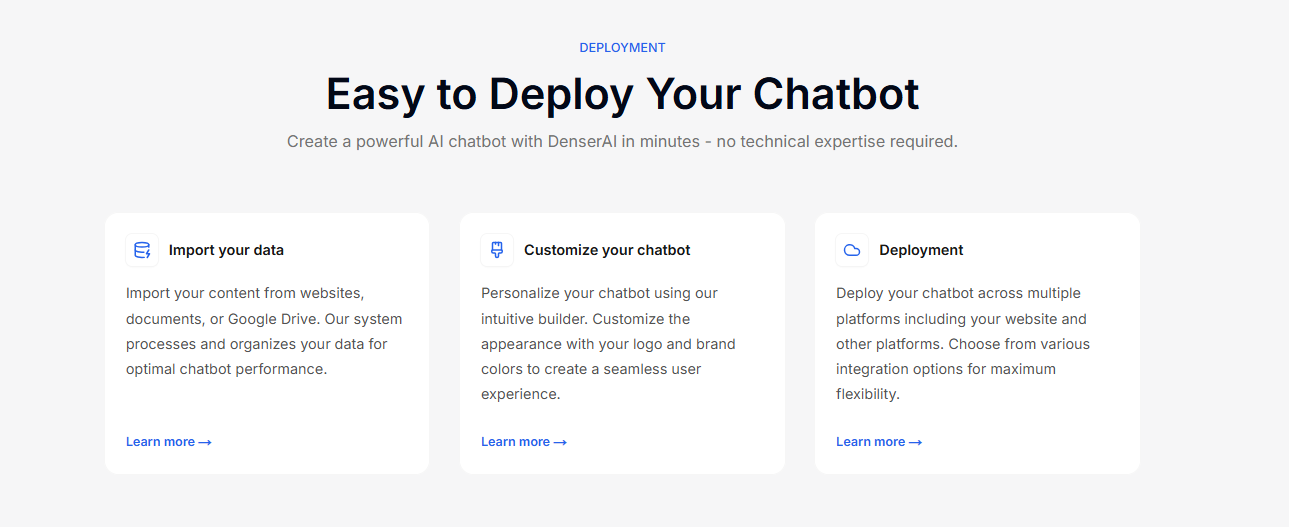

1. Denser#

Denser is a chatbot solution using AI to automate customer support, which is an essential area for fintech and other industries. It allows businesses to create their own AI-powered chatbots and search assistants that can interact with customers in a natural way.

What makes Denser’s approach practical is that you don’t need to train a model from scratch. You can feed the system your existing information, like website FAQs, knowledge base articles, or PDF documents. Then, it will use that data to answer questions accurately.

Denser uses advanced natural language processing, which is the same kind of AI technology behind tools like ChatGPT, to understand customer inquiries and fetch the right information.

For example, a fintech company could use Denser to build a virtual assistant that knows all about their loan products or account services. It helps customers by chatting with them and providing instant answers based on the company’s own latest policies and documentation.

What Makes Denser Stand Out?#

The benefit of this AI-driven support is that it’s available 24/7 and can handle a large volume of inquiries simultaneously. A Denser chatbot can address routine questions without human intervention, which frees up human customer service agents to focus on more complex issues.

Over time, the AI continues to learn from interactions, so it gets better at solving problems and understanding how customers phrase their questions.

Denser has made its solution very user-friendly, which allows you to deploy a custom chatbot in a matter of minutes by importing your data. Sign up for a free trial or schedule a demo today!

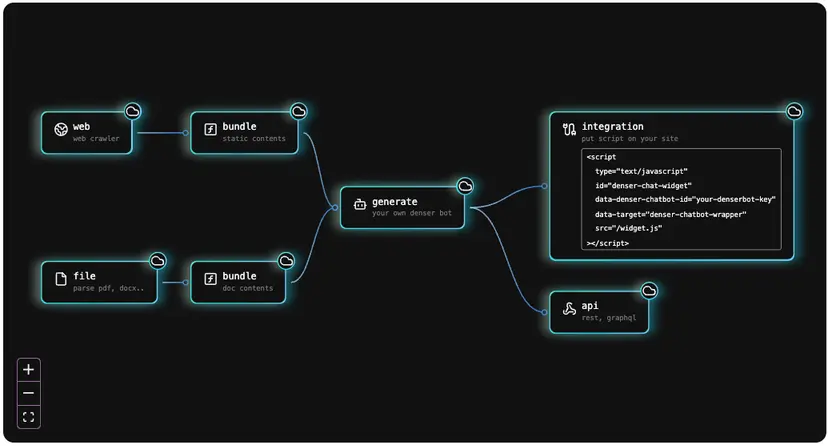

2. Upstart#

Upstart is a lending platform that uses AI to make credit decisions more precise and inclusive. The platform's algorithms consider a broad range of data, including a borrower’s education, employment history, and other factors, to predict creditworthiness.

Image Source: upstart.com

The AI can often identify creditworthy borrowers who might be overlooked by standard models. Upstart reports that its AI-powered solutions approve far more people for loans at lower interest rates compared to a typical FICO-based model.

Upstart also emphasizes fair lending in its use of AI. The company continuously tests its machine learning models to ensure they aren’t introducing bias.

Beyond underwriting, Upstart applies AI to other parts of the loan process as well, like automatically verifying identities, detecting fraud, and confirming income and employment details. These AI-powered tools make getting a loan faster and “instant” in many cases while maintaining security and accuracy.

3. Zest AI#

Zest AI focuses on bringing machine learning to credit underwriting that helps retail banks and credit unions make smarter lending decisions. Instead of one-size-fits-all credit scores, Zest builds custom AI models for lenders that analyze vast datasets to assess a borrower’s credit risk.

Image Source: zest.ai

These models are typically 2-4 times more predictive than generic scoring methods, which gives a more nuanced view of who is likely to repay. In practice, a lender using Zest’s AI might approve up to 25% more applicants without increasing default risk.

In other cases, lenders can keep their approval rates the same but see overall loan losses drop by using more accurate risk management techniques. The goal is to expand access to credit while lending with greater confidence, which is a reflection of rising demands in the fintech market.

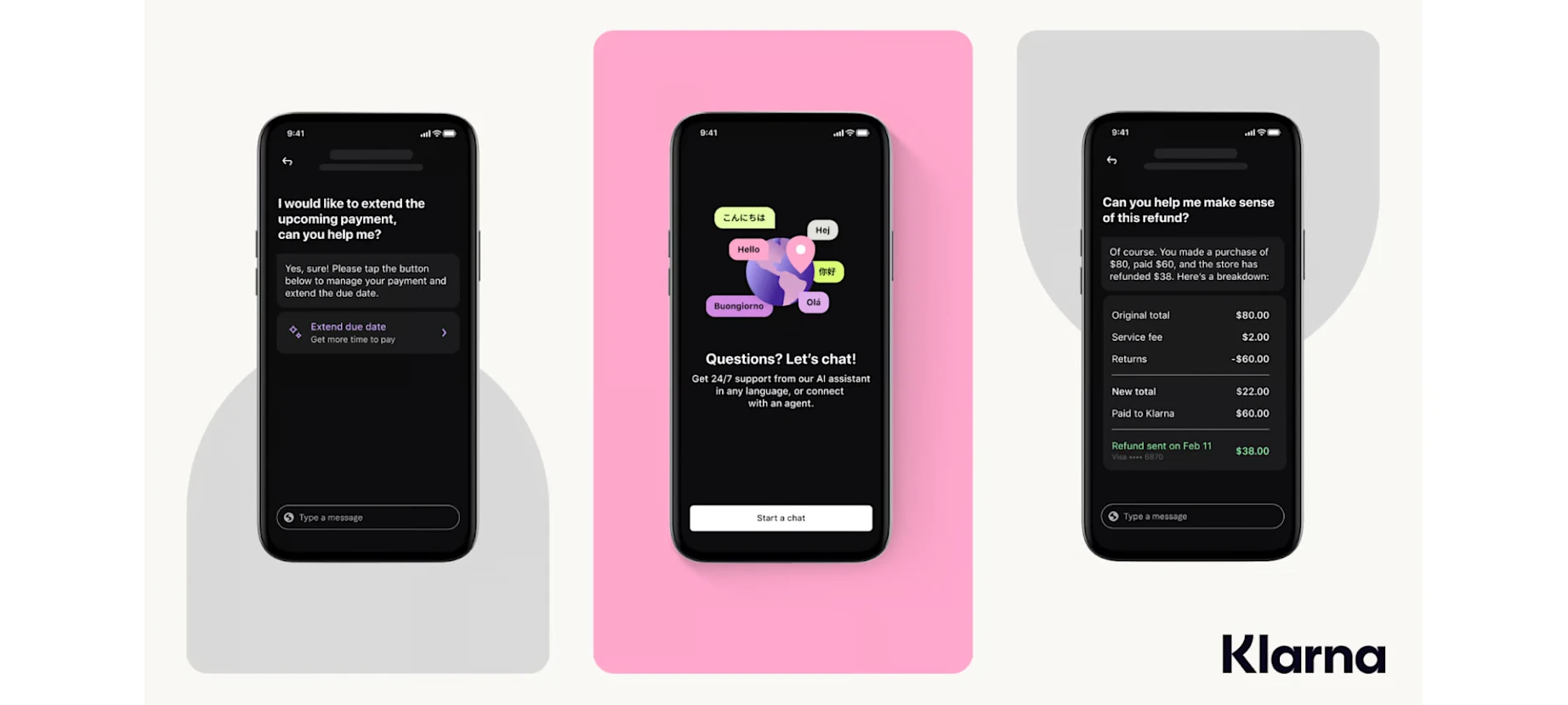

4. Klarna#

Klarna, the Swedish fintech known for “buy now, pay later” services, uses machine learning models for critical tasks like fraud detection systems and credit risk assessment in real time.

Image Source: klarna.com

Every time you attempt a purchase with Klarna, their AI evaluates the transaction almost instantly, checking for signs of fraud and deciding if you’re likely to repay an installment on time. This AI-driven decision-making helps Klarna approve transactions safely and quickly.

Their systems analyze vast amounts of transaction patterns and even predict market movements so they can adjust lending decisions or flag suspicious activity before it becomes a problem.

Klarna also uses AI to improve personalized customer service. The company introduced AI-powered chatbots to handle customer service inquiries, which have dramatically cut response times and costs.

Their AI chatbots have taken over so many routine queries that the company was able to reduce its customer service staff by hundreds of agents. These chatbots use natural language processing to assist customers 24/7, answering questions about payments, deliveries, returns, and more.

5. PayPal#

PayPal has long used behind-the-scenes AI to keep online payments secure. One of the biggest uses of AI for PayPal is fraud detection systems.

Every time a transaction goes through, PayPal’s machine learning algorithms analyze it across hundreds of different variables, from the buyer’s and seller’s history to device and location data.

Image Source: paypal.com

With a customer base of over 400 million users worldwide, this system has a huge dataset to learn what normal behavior looks like and to flag suspicious activity. The result is an AI-driven risk engine that can catch fraudulent transactions in real-time, often stopping fraud before it happens.

At the same time, the AI is smart about not being too strict. It tries to minimize false alarms so that legitimate customers aren’t incorrectly blocked during checkout.

PayPal even offers some of this fraud-fighting AI to other businesses. For example, letting merchants tap into PayPal’s decades of fraud intelligence and machine learning to improve their own risk decisions.

Beyond security, PayPal uses AI to improve the personal side of finance. The company employs data analytics to personalize users’ experiences. It analyzes customer data and preferences to recommend relevant deals or financial products tailored to their personal finance needs.

Types of AI Technologies Used in Fintech#

Several types of AI technology support different parts of the financial sector. Knowing the core types can help you choose the right tools for your platform, products, or internal systems.

Machine Learning#

Machine learning allows systems to learn from historical data and improve their output over time. In the fintech industry, it’s used for credit scoring, fraud detection systems, investment strategies, and behavior analysis.

These models are trained on labeled data, such as past loan repayments or fraud cases. Over time, they start recognizing patterns and making predictions without human instructions.

If your business handles large volumes of sensitive customer data like payment records or transaction histories, machine learning algorithms can help you make smarter decisions with enhanced accuracy.

Natural Language Processing (NLP)#

NLP helps systems understand and respond to human language. This is used in customer support chatbots, document reviews, and voice assistants.

Chatbots built with Denser rely on NLP to interpret what the user is asking and return a useful response. You can set them up to handle real banking or payment questions with natural conversation.

NLP also supports compliance teams by scanning documents, emails, and transcripts to flag risky language or missed disclosures to support data privacy.

Predictive Analytics#

Predictive analytics uses AI to forecast future outcomes. In fintech, this could mean predicting a loan default, spotting a customer at risk of churn, or estimating revenue based on current usage patterns.

These models analyze vast datasets and predict market movements to generate predictions. You can apply this to product recommendations, retention efforts, and performance tracking.

Many payment and lending platforms now use predictive analytics to adjust rates, limits, and risk management categories in real-time.

Robotic Process Automation (RPA)#

RPA automates repeatable tasks like data entry, report generation, and form processing. It uses software bots to follow rules and carry out structured processes.

In fintech, RPA is often paired with AI to handle customer onboarding, KYC documentation, compliance checks, and financial processes.

For example, an RPA bot might collect user data, validate ID documents, and enter results into your CRM without human error.

Deep Learning#

Deep learning is a branch of machine learning that uses neural networks with multiple layers. It’s used when large, complex datasets are involved, such as facial recognition for identity checks or pattern analysis in stock trading.

Deep learning allows systems to identify hard-to-spot relationships in financial data, making it useful for high-frequency trading, risk modeling, and financial goals alignment.

How to Implement AI in Your Fintech Startup#

Bringing AI into your fintech product doesn’t require a large team or deep technical skills. What matters most is choosing the right use case, having clean data, and using tools that match your goals.

Whether you’re automating support or building smarter risk models, a structured approach helps you move faster and avoid wasted effort.

Organize the Data You Already Have#

AI needs data to work well. The quality of your results depends on how clean, complete, and usable your data is.

Before setting up any AI tools, take a look at the information your company has already collected. This might include application forms, user activity logs, transaction records, customer service messages, or uploaded documents.

You don’t need to have perfect data to begin. But it should be labeled and easy to work with. If your customer records are spread across different platforms, it’s worth pulling them into one place to drive operational efficiency.

Choose the Right AI Tools#

Once you know your use case and have your data ready, it’s time to pick the tools that fit your needs. The right tool should match your budget, your current systems, and your technical skill level.

If you’re automating support, a no-code chatbot builder like Denser is a strong place to start. It lets you create bots that answer questions, guide users, and pull info from your own documents.

For scoring or fraud detection, you might use prebuilt AI APIs from platforms like Amazon, Google, or Microsoft. These tools allow you to run predictions, review behavior, or flag unusual activity by connecting to your existing app.

To explore more sophisticated applications like autonomous workflows and multi-step decision-making, check out this article about agentic AI use cases.

Track Performance and Improve#

Once your AI feature is live, you need to track how it’s performing and make steady improvements.

You might notice certain questions aren’t being answered clearly or that users leave when the bot gives a generic response. These signals show you where to adjust flows, add new information, or improve the way the bot understands questions.

For predictive models like fraud detection or loan scoring, you need to monitor how often the AI gets it right. Compare predictions to actual outcomes. Over time, you’ll build trust in the model and identify areas to fine-tune, which leads to better customer satisfaction.

Expand Slowly and Stay Focused#

Once your first AI feature is working well, it’s tempting to add more right away. However, adding too much too fast can lead to confusion. Instead, choose your next step carefully and build on what’s already working.

If your chatbot is handling support successfully, maybe it’s time to use it for onboarding or account updates. If your AI model is flagging fraud accurately, you can apply a similar system to payment errors or refund requests.

Growing slowly keeps your product stable and your team focused. It also gives you time to learn what your users respond to and what your systems can handle. That way, each AI feature you launch makes your fintech platform stronger.

Use AI to Power 24/7 Fintech Customer Support—Try Denser!#

If you're looking to save time or scale without adding more to your team’s plate, Denser gives you a smart way to make that happen.

With Denser, you can build AI chatbots that respond to real customer questions using your own data.

You can set it up with content from your help center, product docs, or internal tools, and it will start answering users instantly. It’s a simple setup, and you don’t need to write code or manage complex systems.

If you’re ready to bring AI into your fintech business, Denser helps you do it with confidence, which makes room for a stronger customer experience.

Sign up for a free trial or schedule a demo to see how AI can make your product smarter and your service stronger.

FAQs About AI in Fintech#

What is the use of AI in fintech?#

AI helps companies in the financial industry work faster, reduce manual tasks, and make better decisions. It’s used for things like fraud detection, credit scoring, customer support, and risk analysis.

AI reviews large sets of data and makes decisions automatically, which helps businesses save time and offer smoother service to users.

How is AI being used in financial services?#

AI supports real-time monitoring, automates service, and enhances how loans and investments are handled. It also supports onboarding, detects account activity, and personalizes finance tools that contribute to financial inclusion by expanding access to underserved customers.

How is AI used in the tech industry?#

AI powers chatbots, search engines, voice systems, and more. In fintech, it supports identity checks, payments, and insights, helping teams and financial advisors stay efficient and giving users better ways to transfer money securely.

How is AI transforming the future of fintech?#

AI is making fintech more flexible and more user-focused. Companies can now offer personalized services at scale, detect fraud before it happens, and make smarter decisions with less effort.

As AI tools become easier to use, even small teams can build smart, reliable systems that improve customer experience, drive innovation, and deliver measurable cost savings across operations.