Fintech Chatbots: What They Are and How You Can Use Them

Financial institutions are seeing a shift in how customers want to interact with their services. People now expect quick access to their financial information without the hassle of long wait times or complex systems.

AI-powered chatbots offer instant help with tasks like checking account balances, tracking transactions, or answering questions. This helps customers and cuts down on costs for financial institutions.

As the demand for faster and better service grows, fintech chatbots are becoming an essential part of the modern finance industry.

In this article, we'll explore how these chatbots are changing customer service, the benefits they offer, and why they're becoming essential for financial sectors.

What Are Fintech Chatbots?#

Fintech chatbots are specialized AI-powered programs that financial institutions use to interact with customers. They're designed to automate and simplify customer interactions by handling routine banking tasks, providing answers to common questions, or even processing transactions.

But what makes these chatbots different from the regular chatbots you might see on e-commerce websites?

Their difference is the deep integration with banking systems and their ability to handle sensitive financial data. They securely manage things like account balances, investments, and payments.

Financial chatbots use a technology called Natural Language Processing (NLP). It gives bots the ability to understand and respond to human language. When users type or say something like, "What's my checking account balance?", the chatbot understands its meaning and fetches the right information from the bank's system.

Benefits of Fintech Chatbots for Financial Institutions#

Now that we've explored the key features of fintech chatbots, it's time to explore why they're so beneficial in the financial services industry:

24/7 Customer Support#

Customers expect access to their banking services at all times. Chatbots can meet that demand. Financial chatbots allow banks and other financial institutions to offer assistance around the clock without expanding human customer support teams.

Cost Savings and Operational Efficiency#

Some institutions traditionally rely on large customer service teams to handle routine inquiries, which can be costly for financial operations. Chatbots offer a scalable solution to manage these tasks without constantly hiring and training new staff.

Chatbots can handle simple tasks like balance checks, transaction tracking, and password resets, allowing human agents to focus on sensitive customer needs. This reduces overhead while ensuring that customers continue to receive high-quality service.

Personalized Customer Service#

Financial services chatbots can also bring personalization to the customer experience. They can analyze user data to offer tailored financial advice and suggestions based on individual needs.

A chatbot can analyze users' spending patterns and suggest personalized savings plans or investment options. Customers are more likely to stay engaged with services that understand their needs and provide relevant solutions.

Simplified Financial Processes#

Beyond customer service, chatbots help simplify key financial processes for the financial sector.

Instead of filling out complex forms manually or waiting for a bank representative, customers can interact with a chatbot that guides them through the application process. The chatbot can collect the necessary information, verify eligibility, and even provide an initial decision—all in real time.

KYC verification is a time-consuming process that is mandatory for financial institutions to comply with anti-money laundering regulations. Chatbots can help speed up this process by automating document submission and verification.

Improved Security and Fraud Detection#

Security is always a top concern in the financial industry, and fintech chatbots are important in improving it.

Financial services chatbots can monitor real-time transactions and flag any suspicious activity. For example, the chatbot can immediately alert the customer for confirmation if an unusual transaction is detected, such as a large withdrawal from a foreign location.

Popular Use Cases of Fintech Chatbots#

Let’s check out some of the most common use cases where these AI-powered assistants make a big impact.

1. Digital Transactions#

Users can complete tasks such as transferring money, paying bills, or checking recent transaction histories through simple, natural language interactions. This eliminates the need for users to navigate through complex menus in traditional banking apps.

2. Investment Advice#

Finance chatbots can analyze market data, user preferences, and financial goals to provide personalized investment suggestions. It makes investing accessible for individuals who may not have regular access to a financial advisor.

3. Financial Insights#

Fintech chatbots can track spending patterns, analyze budgets, and provide data-driven advice to help users manage their finances better.

A user might ask, "How much did I spend on groceries last month?" The chatbot will scan recent transactions and provide an accurate report. It could also suggest ways to save money or improve spending habits, enhancing financial well-being.

4. Customer Support#

Finance chatbots are often used to deliver customer support in real time. The bots can answer questions, resolve issues, and provide essential banking information. This ensures customers receive prompt assistance without waiting for a human agent.

5. Account Management#

Chatbots offer an efficient way to manage personal accounts. From checking balances to reviewing transaction histories, they provide easy access to important financial information and help customers complete account-related tasks.

6. Financial Advice#

Chatbots can suggest changes or recommend new investment strategies to help users achieve their objectives. They might review a user's portfolio and suggest reallocating investments based on recent market trends. It can also offer general advice on long-term savings or retirement planning.

7. Detect and Prevent Fraud#

A fintech chatbot can identify suspicious behavior and immediately notify the user.

If an unusual transaction occurs—like a large purchase in a foreign country—the chatbot can flag it and ask the user to confirm. If the answer is no, the chatbot can freeze the account to prevent further activity.

With real-time monitoring, you reduce the risk of financial fraud. Users will have peace of mind knowing their accounts are being watched closely.

8. Insurance and Loan Applications#

Instead of filling out long forms or speaking with multiple agents, customers can use finance chatbots to apply for loans or insurance policies.

The chatbot walks users through the necessary steps to complete their applications, collect information, verify eligibility, and even provide instant decisions for smaller loans. The chatbot offers tailored insurance options based on the customer's needs.

Challenges Facing Fintech Chatbots#

Like any technology, there are obstacles that financial institutions need to address to get the most out of these AI tools. Let's take a closer look at some of the key challenges fintech chatbots face and how you can overcome them:

User Trust and Data Privacy Concerns#

Since chatbots often handle sensitive financial information, customers must feel confident that their data is protected.

People might hesitate to fully engage with chatbots if they aren't sure how their information is being handled. In a time when cybersecurity threats are common, concerns around data privacy can be a major barrier to chatbot adoption.

Overcoming the challenge: Clear communication is key. You must be transparent about storing, securing, and using customer data.

Chatbots should also comply with strict security standards such as PCI DSS and GDPR to assure users their data is safe. Regular updates about security protocols help alleviate user concerns and build trust over time.

Regulatory Compliance#

The banking industry is one of the most regulated sectors, and for good reason—handling people's money requires strict oversight. One of the major challenges for fintech chatbots is making sure they comply with these regulatory requirements.

Overcoming the challenge: Financial institutions need to ensure that their chatbots are designed to meet the highest security and privacy standards right from the start. This often involves working closely with legal teams to ensure compliance with all relevant regulations.

Additionally, it helps integrate compliance checkpoints into the chatbot's development process so that you can address any regulation changes quickly.

Limitations of AI and NLP#

While chatbots are great at managing routine questions, they sometimes struggle with complex inquiries.

Not all customer questions are simple—some require detailed, nuanced answers that chatbots might not be equipped to handle. For instance, a customer asking about the tax implications of a certain investment strategy or needing advice on a complicated financial product may find that the chatbot's answer lacks depth.

Overcoming the challenge: A hybrid approach is often the best solution, where chatbots handle simple queries and pass more complex issues to human agents. The key here is smooth handoff—customers should never feel like they're being bounced between systems.

A chatbot should be able to recognize when it's out of its depth and transfer the conversation to a human agent without disruption.

Managing User Expectations#

Many users may expect chatbots to function at the same level as a human representative, which isn't always true. When a chatbot fails to understand a request or delivers a generic response, it can lead to frustration and dissatisfaction.

Traditionally, chatbots have had limitations in providing guidance and can only be as effective as the data they're trained on. However, advancements in AI technology are closing this gap.

Advanced chatbots such as Denser.ai use semantic AI technology to understand intent in queries. It allows them to interpret subtle nuances in how customers phrase their questions.

Even with these improvements, there are still times when human intervention is necessary, especially for very detailed or personalized guidance.

Overcoming the challenge: You should communicate the chatbot's capabilities upfront, letting customers know what it can and cannot do. A message explaining that the chatbot can handle routine banking inquiries, but complex financial advice will be escalated to a human advisor.

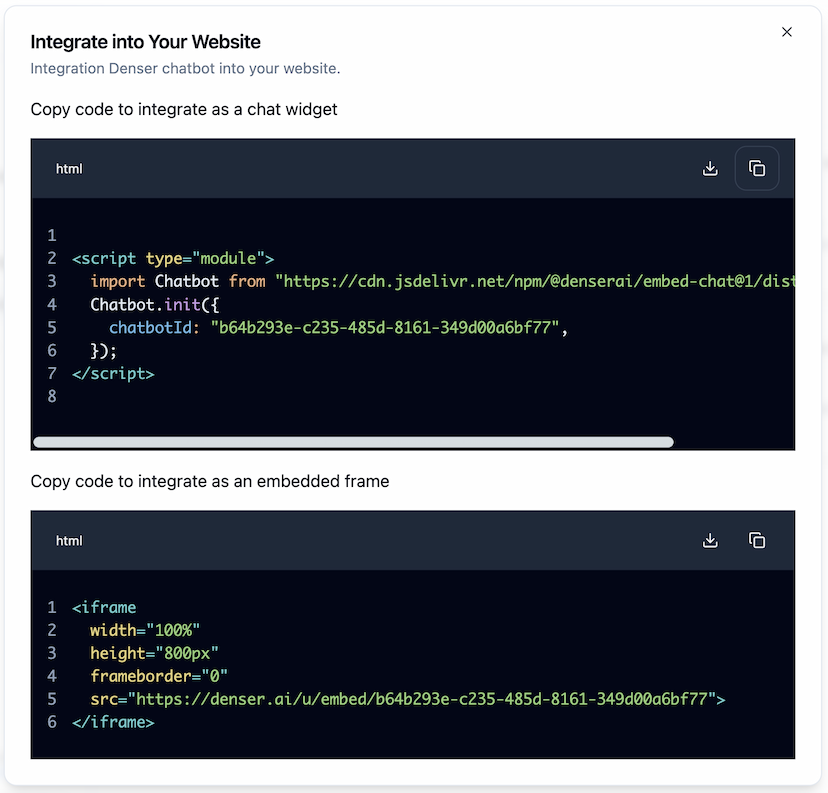

How to Build a Finance Chatbot With Denser.ai#

Thinking about building a finance chatbot but worried it might be too complex? With Denser.ai, creating a chatbot that handles financial tasks doesn't require any coding.

Denser.ai gives you all the tools to create a smart, reliable chatbot. Let's walk through the steps to get your finance chatbot up and running.

Step 1: Sign Up With Denser.ai#

Create your free account on Denser. Don't worry if you're not a tech expert—the platform is designed for ease of use. You can navigate the setup without any technical headaches.

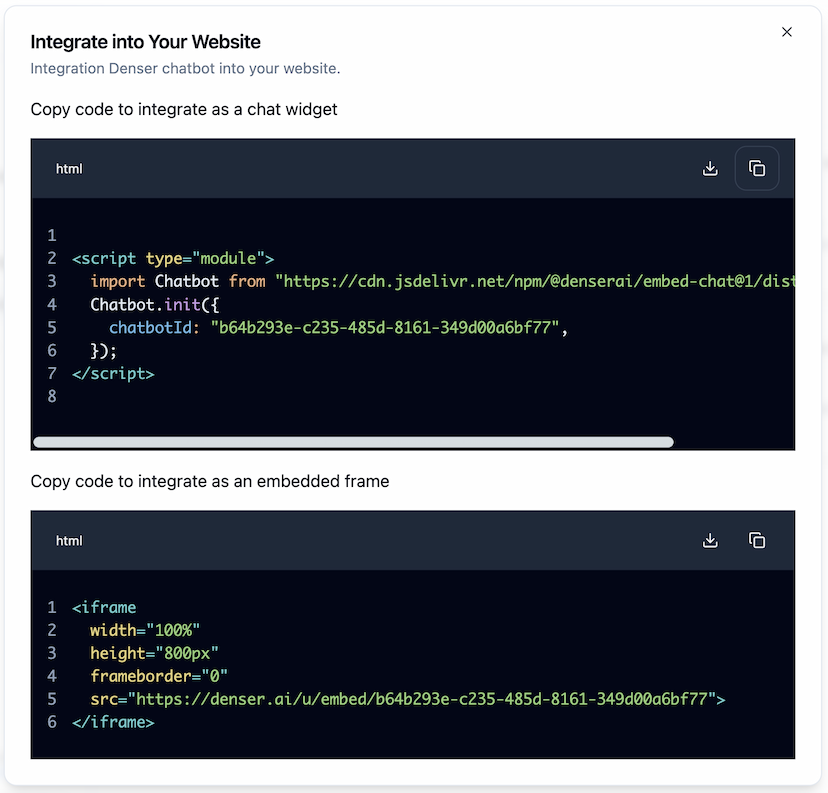

You can click the Copy icon to copy the code snippet to your clipboard, then paste it into your website’s HTML file.

Follow this full integration guide.

Step 2: Define What Your Chatbot Will Do#

Before building your first chatbot, knowing what it will handle is important.

Will it help customers check balances, answer loan questions, or offer financial advice?

Knowing this will help you set up the right functions. Denser.ai provides templates based on common financial tasks, so you can quickly customize your chatbot to meet your specific needs.

Step 3: Train Your Chatbot With Smart Conversations#

DenserBot, powered by large language models (LLMs), delivers real-time, intelligent responses by understanding customer intent.

You can train the chatbot to handle common financial queries—like "What's my account balance" or "How can I apply for a loan"—while ensuring the chatbot's tone matches your brand.

Step 4: Connect Your Financial Systems#

You'll want to integrate your chatbot with your existing financial systems. Denser.ai supports seamless integration with customer management platforms and other tools. Your chatbot can securely handle real-time data, perform transactions, and assist with account-related tasks.

Step 5: Test Your Chatbot's Performance#

Once your chatbot is set up, it's time to test it. Denser.ai allows you to simulate various customer scenarios to ensure your chatbot handles inquiries correctly. You can adjust its responses to ensure smooth and accurate interactions before going live.

Step 6: Launch Your Finance Chatbot#

Now that your chatbot is tested and ready, it's time to launch!

Denser.ai makes it easy to deploy your chatbot across multiple channels, including your website, mobile app, or popular messaging platforms. Customers can get instant, personalized help whenever needed—without waiting in line or calling customer service.

Step 7: Monitor and Improve#

After your chatbot is live, Denser.ai provides powerful analytics to track its performance. You'll get insights into the types of questions customers ask, response times, and overall customer satisfaction.

Based on this data, you can continually optimize your chatbot, ensuring it delivers the best possible user experience.

Reduce Costs and Automate Finance Tasks With Denser.ai#

Looking for an optimal way to make your financial services faster and more efficient?

Denser's semantic AI technology can automate customer interactions, from routine banking inquiries to more complex tasks like loan or investment assistance.

This intuitive AI chatbot is built to handle the high demands of financial institutions, managing large volumes of customer inquiries while maintaining efficiency and 24/7 availability.

Integrating Denser.ai is simple and doesn't require technical expertise. You can quickly set it up to start automating processes, improving customer satisfaction, and freeing up your team for more strategic tasks.

For financial services and other professional service firms, explore our Professional Services Chatbot page to see how financial advisors, wealth management firms, consulting practices, and other professional services use Denser AI to capture leads 24/7, automate client inquiries, and search through thousands of documents.

Let Denser.ai help you transform your financial services into a smart, scalable solution—without the coding hassle. Sign up for a free trial, or schedule a demo today!

FAQs About Fintech Chatbots#

How customizable are fintech chatbots?#

Fintech chatbots are highly customizable to suit the specific needs of the banking and financial sectors. They can be tailored in terms of language, tone, and functionality. Financial institutions can set custom workflows, define how the chatbot handles certain inquiries, and align it with branding guidelines.

How can fintech chatbots help with customer retention?#

Fintech chatbots improve customer retention by offering a better user experience. They provide immediate assistance, personalized financial advice, and 24/7 availability, which increases customer satisfaction.

Additionally, chatbots can proactively engage customers with reminders, suggestions for better financial products, or check-ins, which keeps customers engaged and reduces churn.

How do fintech chatbots contribute to customer engagement?#

Chatbots improve customer engagement by maintaining constant business communication with users. Through proactive notifications, personalized financial insights, and quick responses to inquiries, chatbots keep customers informed and engaged with their financial services.