How to Lower Customer Service Costs Without Losing Quality

Customer service costs can drain your business if you are not paying attention. From staff salaries to software subscriptions, these expenses stack up faster than you realize.

For many businesses, customer service is one of the largest ongoing expenses. Wages, training, turnover, and technology all add to the bill, while indirect costs make it even harder to manage.

If these areas are not addressed, you end up paying more than necessary without improving the quality of your service. But with the right strategies, you can reduce spending and improve efficiency at the same time.

In this guide, we will explore the importance of analyzing customer service costs and how you can control them without lowering the level of support your customers expect.

Lower Your Support Budget With AI Automation - Try Denser!#

If you are paying too much for repetitive tasks or constant staff turnover, your budget is working against you instead of for you. Many of these costs are avoidable with the right tools in place.

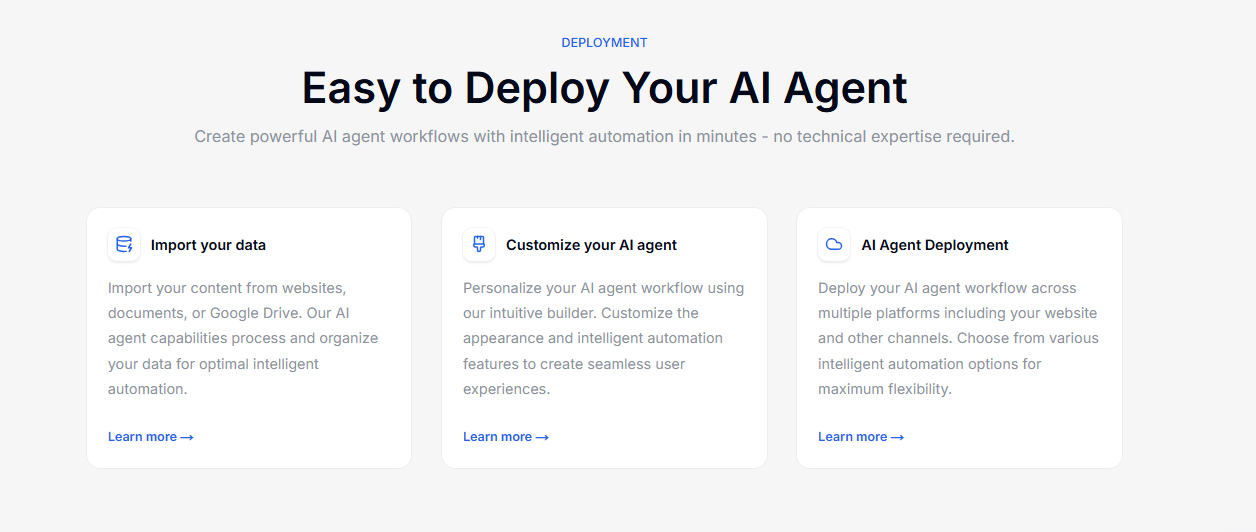

Denser is an AI-powered chatbot that takes on routine interactions around the clock, so your team is not tied up with the same tasks over and over again.

That means you cut down on labor costs, shorten wait times, and keep your human team focused on the issues that need their expertise.

Denser helps you protect your budget and your customer loyalty by controlling your customer service costs with automation. You gain a more sustainable support AI agent that delivers consistent service while freeing your human reps to focus on complex conversations.

If reducing costs while keeping customers satisfied is your goal, Denser is the solution to consider. Request a product demo or sign up for a free trial today!

Are You Underestimating Your Customer Service Costs?#

Customer service costs are easy to track with just wages, a help desk tool, and a bit of training. However, when you factor in onboarding new hires and the productivity lost when your systems don’t work together, the price tag grows quickly.

If you are not keeping an eye on these hidden operational costs, you may be underestimating how much service is really costing you.

A study by Gallup shows that replacing a single customer support representative can cost you 40% of their annual salary. If you’ve been surprised by rising expenses, this is probably why.

But beyond statistics, think about how this affects customer retention. If you underestimate your service costs, you may cut corners without realizing it. That could mean longer wait times, stressed staff, and poor customer service that frustrates people and leads them to leave.

Every lost customer pushes you to spend more on marketing and sales to fill the gap, and suddenly, your “savings” on service don’t look like savings at all.

The good news is, once you recognize these underestimated costs, you can make smarter moves.

When you start adopting tools like chatbots for simple, repetitive customer interactions, you give your customer support team breathing room to focus on higher-value conversations. It helps you save money while building stronger customer loyalty and keeping people coming back.

Types of Customer Service Costs#

When you think about good customer service, it helps to break costs down into clear categories. This way, you can see where your money is going and spot the areas that may be draining more than they should.

Labor and Staffing Costs#

Your largest expense will almost always be people. Salaries, benefits, and overtime pay quickly add up. On top of that, training new staff and handling turnover can quietly inflate your budget.

Every time an agent leaves, you spend time and money to recruit and train a replacement, which adds strain on your finances and your service team.

Technology and Tools#

From help desk platforms to chatbot solutions, your technology spend is another major part of service costs. The right tools can reduce customer support costs by handling more requests with fewer people.

For example, AI-powered customer support can answer repetitive questions 24/7, cutting down on staffing needs. But if you pay for too many overlapping tools or fail to adopt automation, your tech costs may become heavier than expected.

Infrastructure Costs#

If you run physical call centers or offices, you face costs tied to rent, utilities, and equipment. Even remote teams are not free from these expenses, such as laptops, headsets, and secure networks.

These maintenance costs grow as your team scales, which makes it important to plan instead of being caught off guard.

Outsourcing vs. In-House Costs#

Some businesses turn to outsourcing to save money, but this isn’t always cheaper. While outsourcing can reduce overhead, it can also add costs in the form of quality control, vendor management, and lost brand connection with customers.

On the other hand, in-house teams give you more control but come with higher fixed costs. You need to weigh both options based on your business goals and your support team’s ability to handle volume.

Indirect Costs#

Some costs don’t appear on your budget sheet but still impact you.

For example, slow service can lead to lost sales. Poor training can lower productivity. Long resolution times may frustrate customers, causing churn. These are all indirect costs that cut into your profit, even though they don’t show up as a clear expense line.

In many cases, customers prefer fast responses and easy access to help, which means indirect costs can have a lasting effect on customer lifetime value.

How to Calculate Customer Service Costs#

Once you calculate these costs, you gain a better view of what it takes to support your customers and where money may be slipping away. Let’s look at the most common ways you can measure them.

Cost per Contact#

This is the average amount you spend every time a customer reaches out. To calculate it, you need to divide your total customer service expenses by the number of contacts handled.

Formula: Total Service Costs ÷ Total Number of Contacts = Cost per Contact

Example: If you spend $100,000 a year on service and handle 50,000 contacts, your cost per contact is $2.

Cost per Resolution#

Some customer questions are quick, but others take multiple steps. Cost per resolution helps you see the average expense of solving a customer’s issue.

Formula: Total Service Costs ÷ Total Number of Resolved Cases = Cost per Resolution

Example: If your team closes 20,000 tickets in a year with $100,000 in costs, each resolution costs $5.

Cost per Channel#

Different service channels come with different price tags. Phone support is often the most expensive due to the time it takes per call. Live chat usually costs less.

Self-service tools, such as knowledge bases and chatbots, bring costs down even further. Comparing costs across channels shows you where to focus investment so you can deliver better service without overspending.

Customer Service Cost Benchmarks by Industry#

These benchmarks give you a sense of how your costs measure up and where you may be overspending. While exact numbers vary by company size and complexity, industry averages can help you set a baseline.

Retail and E-Commerce#

In retail, volume is high, and questions often repeat, including shipping updates, returns, and product details. Research shows the average cost per contact ranges between $2 and $5.

Companies in this space save money by using self-service portals and retail AI chatbots to handle routine questions. If you run an online store, shifting “Where’s my order?” requests to a chatbot can reduce your support costs.

SaaS and Technology#

Costs run higher for software companies. Customers sometimes need technical help, troubleshooting, or onboarding support. Average costs per resolution can go from $6 to $12, depending on complexity.

SaaS businesses that invest in automation, in-app guides, and AI technical support often bring these numbers down, while also speeding up response times.

Healthcare#

Healthcare service costs are unique because they carry compliance expenses, security requirements, and specialized staff training. The price per contact averages between $7 and $13, which is among the highest of all industries.

While you can’t cut corners here, automation and secure AI agents for healthcare can reduce the load for simple scheduling, reminders, and FAQ-style support.

Financial Services#

Banks, insurance companies, and financial platforms deal with sensitive and regulated information. Like healthcare, costs are higher due to compliance and specialized staff.

The average price per contact can reach $10 to $15. Many institutions are adopting AI-driven chatbots for tasks like balance checks or policy FAQs, saving human staff for complex requests.

Recommended Reading:

10 AI Use Cases in Financial Services You Need to Know

Factors That Influence Customer Service Costs#

Customer service costs are shaped by the way you structure your customer service team, the tools you invest in, and the type of customers you serve. Understanding these factors helps you take control of your expenses instead of being surprised by them.

Customer Volume and Complexity#

The more customers you serve, the more contacts you’ll handle. But it’s not just about numbers, but also the complexity that plays a big role.

A high-volume business answering simple “order status” questions will spend less per contact than a SaaS company guiding users through technical integrations.

When your customer queries are complex, costs rise because they take more time, more resources, and often more skilled customer service agents to resolve.

Service Channels Used#

The support channels your customers choose directly affect costs. Phone calls take longer and cost more than email, online chat, or social media support. Self-service channels and AI agents cost far less.

If most of your volume comes through expensive methods, you should guide users toward lower-cost options. Contact center software also helps you track requests across multiple platforms and manage your team better.

Training and Employee Turnover#

Agent training has a big impact on costs. A knowledgeable agent solves problems faster, which improves service quality and lowers the average price per resolution. On the other hand, turnover disrupts operations and increases expenses.

Every time you replace a member of your support staff, you pay for hiring, onboarding, and lost productivity. High turnover also raises the chance of bad customer service, which damages brand loyalty over time.

Technology Adoption#

Technology can either lower costs or inflate them. Outdated communication tools and disconnected internal processes create wasted time and higher cost structures.

Modern tools like chatbot automation and ticket routing allow support agents to focus on support interactions that matter, not repetitive routine tasks.

Smart systems for support operations give you valuable insights into customer data and customer history. These help you predict needs and improve operational efficiency.

Effective Strategies to Reduce Customer Service Costs#

If you want to cut costs in customer service, it does not mean you have to lower the standard of support you give. The smartest approaches bring cost reduction while still delivering a positive customer experience.

Here are some proven cost-saving strategies you can put into place.

Invest in Self-Service Options#

Many of the questions your team answers every day are repeated, and handling them with human agents increases expenses.

Once you build a self-service portal with FAQs or step-by-step tutorials, you reduce the number of incoming requests and the hours spent by your support staff.

Instead of just browsing articles, customers can ask direct questions and get immediate responses from a customer service AI tool. A chatbot runs 24/7, which means costs do not rise when many customers reach out during peak times.

Request a product demo or sign up for a free trial with Denser today!

Automate Repetitive Tasks#

A large share of service work comes from routine tasks such as routing a support ticket, sending follow-ups, or confirming appointments. When agents are caught in these loops, they add to your support operations without improving the overall service experience.

Automation addresses this by taking repetitive work off your team’s plate. Automated ticket systems can assign cases, while messaging automation handles simple updates. This frees your team to focus on complex customer interactions that require context and empathy.

When combined with chatbots, AI automation can significantly impact your operational efficiency and your overall service quality.

Optimize Staffing Models#

One hidden cost comes from staffing mismatches. If you overstaff, you’re paying for idle time. If you understaff, you pay overtime and risk customer frustration.

The smarter approach is to use data to guide your staffing. You need to look at your busiest hours, peak seasons, and ticket patterns to see when your team is required.

Analytics tools can help you predict demand, which means you can schedule the right number of agents at the right times. This balance enables you to control costs while avoiding gaps in service.

Another way to optimize is by mixing staffing models. You might keep a core team of human agents for complex requests and rely on outsourced or part-time workers for peak times.

Chatbots can provide after-hours support, so you do not need to maintain extra office space or add unnecessary software licenses. This blend gives you cost optimization without sacrificing quality.

Cross-Train Employees#

When employees are only trained for a single task, you often need larger teams to cover different types of requests. Instead of limiting agents to one kind of task, cross-train them so they can handle multiple types of requests.

Continuous improvement through cross-training helps your service team become more flexible. A cross-trained, knowledgeable agent can handle billing, technical issues, and general questions, which lowers staffing needs and strengthens customer relationships.

Cross-training also reduces case transfers and improves speed. It creates a smoother path toward excellent service by delivering a positive customer experience consistently.

Outsource Smartly#

Outsourcing may seem like the easy way to cut costs, but over-reliance can damage customer relationships. If too much is outsourced, you lose control over tone, accuracy, and your ability to provide better service.

The smarter move is to outsource only where it's relevant. For example, outsourcing after-hours coverage or overflow during seasonal spikes can support you without hurting your support interactions.

At the same time, in-house teams keep control over complex issues where customers expect personalized attention. Using automation alongside selective outsourcing allows you to streamline operations and keep delivering excellent service while lowering overhead.

FAQs About Customer Service Costs#

What are customer service costs?#

Customer service costs are all the expenses you take on to support your customers. This includes salaries for agents, training programs, tools like help desk software, and hidden costs such as turnover or churn when service falls short.

In short, it is every dollar you spend to make sure customers get the help they need while maintaining customer satisfaction.

What is the 10 to 10 rule in customer service?#

The 10 to 10 rule is a common practice in retail and hospitality. It means that within 10 feet of a customer or within 10 seconds of noticing them, your staff should acknowledge or greet them.

While it is not a cost metric, it impacts your costs indirectly. Better engagement reduces complaints, shortens service times, and builds loyalty, which lowers churn-related expenses. Many customers report that quick recognition from staff is one of the simplest ways to improve their service experience.

What is the cost to serve per customer?#

The cost to serve per customer measures how much you spend to support one customer over a set time. It includes every contact they make, such as calls, emails, chats, or self-service usage.

For example, if your yearly service budget is $200,000 and you support 20,000 customers, your cost to serve per customer is $10 per year. Knowing this helps you see how much each customer context is costing you and where you can improve.

What do customer costs include?#

Customer costs include direct and indirect expenses. Direct costs are things like wages, tools, and outsourcing fees. Indirect costs include lost productivity, churn, and the opportunity cost of agents tied up with repetitive work instead of focusing on higher-value issues.

Modern tools like chatbots, social media mentions monitoring, and automation can help reduce these types of costs. They allow you to meet customers where they are while keeping service consistent and scalable.